Calgary, Alberta, September 26, 2019 – MG Capital Corporation (TSXV: MGX.P) (“MG” or the “Corporation”) is pleased to announce that further to its news release dated July 29, 2019, it has entered into an amalgamation agreement dated September 26, 2019 (the “Amalgamation Agreement”) with DLP Resources Inc. (“DLP”), a privately held corporation incorporated under the laws of the Province of British Columbia and 1224395 B.C. Ltd., a wholly owned subsidiary of MG, incorporated under the laws of the Province of British Columbia (“NumCo”) pursuant to which MG will, by way of a “three-cornered amalgamation”, acquire all of the issued and outstanding securities of DLP (together with the related transactions and corporate procedures set forth in the Amalgamation Agreement, the “Transaction”).

The Transaction is subject to TSX Venture Exchange (the “TSXV”) approval and is intended to constitute MG’s “Qualifying Transaction” in accordance with TSXV Policy 2.4 – Capital Pool Companies.

Summary of the Transaction

Pursuant to the terms of the Amalgamation Agreement, and subject to certain conditions, including receipt of applicable regulatory and shareholder approvals, DLP will amalgamate with NumCo pursuant to the provisions of the Business Corporations Act (British Columbia) (the “Amalgamation”). The amalgamated entity (“AmalCo”) will be a wholly-owned subsidiary of MG and the shareholders of DLP will be issued one common share of MG (each an “MG Share”) in exchange for every one Class A Common Share of DLP (each a “DLP Share”) held immediately prior to the completion of the Transaction. Each outstanding common share purchase warrant of DLP (each a “DLP Warrant”) will also be exchanged for one common share purchase warrant of MG on the same terms and conditions as the original security.

The Amalgamation Agreement provides that no party will solicit or negotiate with any other entities in opposition to or in competition with the Transaction.

The completion of the Transaction is subject to the satisfaction of certain conditions precedent, including but not limited to: (i) the DLP Financing (as defined below), raising gross proceeds of not less than $1.1 million; (ii) approval of the Amalgamation by the shareholders of DLP; (iii) the absence of any material adverse change in the business, operations or capital of either MG or DLP; (iv) the absence of any prohibition at law against the Transaction; (v) the termination by MG of 540,000 of the currently outstanding stock options held by its current directors and officers; and (vi) receipt of all requisite third party consents, waivers, permits, orders and approvals, including the approval of the TSXV. Accordingly, there can be no assurance that the Transaction will be completed on the terms proposed above or at all. For avoidance of doubt, the Amalgamation is not subject to the approval of the shareholders of MG.

Subject to satisfaction or waiver of the conditions precedent referred to herein and contained in the Amalgamation Agreement, MG and DLP anticipate that the Transaction will be completed on or before November 1, 2019.

Each of MG and DLP will bear their own costs in respect of the Transaction except that DLP will pay all third party costs required to be paid to complete the Transaction, including, but not limited to sponsorship fees and any and all TSXV filing fees.

The Transaction will result in MG, as the listed issuer resulting from the Transaction (the “Resulting Issuer”), owning 100% of the securities of DLP.

In connection with its role in connecting MG and DLP in contemplation of the Transaction and subject to TSXV approval, there is a finder’s fee payable to Haywood Securities Inc. (“Haywood”) to be satisfied through delivery to Haywood of $192,500, payable in cash or through the issuance of DLP Shares at a price of $0.10 per DLP Share (the “Finder’s Fee”).

DLP Financing

The Transaction is subject to the completion of a non-brokered private placement by DLP for minimum aggregate gross proceeds of $1,100,000 (the “DLP Financing”). In the DLP Financing, DLP expects to raise funds through the issuance of flow-through common shares of DLP (each a “DLP FT Share”) at a price of $0.13 per DLP FT Share and through the issuance of units of DLP (each a “DLP Unit”) at a price of $0.10 per DLP Unit. A minimum of $575,000 will be raise through the issuance of DLP Units. Each DLP Unit will be comprised of one DLP Share and one-half of one DLP Warrant. Each DLP Warrant will entitle the holder thereof to purchase one additional DLP Share at an exercise price of $0.15 per DLP Share for a period of 24 months from the date of issue, subject to the Acceleration Right (as defined below). Each DLP FT Share will be a flowthrough share which will qualify as a “flow-through share” as defined in s. 66(15) of the Income Tax Act (Canada).

The “Acceleration Right” means the right of DLP to accelerate the expiry date of the DLP Warrants to 30 daysfrom the date notice of such acceleration is delivered to warrantholders if the closing price of the shares of the Resulting Issuer on the TSXV, or any other stock exchange on which such shares are then listed, is at a price equal to or greater than $0.25 for a period of twenty consecutive trading days.

DLP expects to pay a cash commission equal to up to 7.5% of the aggregate combined gross proceeds raised from the sale of applicable DLP Units and DLP FT Shares to subscribers introduced to DLP by qualified finders and also expects to issue (i) such number of non-transferable warrants (“FT Finder Warrants”) that is equal to 7.5% of the gross proceeds raised in respect of the issuance of DLP FT Shares to subscribers introduced to DLP by such finders, divided by $0.13 and (ii) such number of non-transferable warrants (“Unit Finder Warrants”) that is equal to up to 7.5% of the gross proceeds raised in respect of the issuance of DLP Units to subscribers introduced to DLP by such finders, divided by $0.10. Each FT Finder Warrant will entitle the holder thereof to acquire one DLP Share for a period of 24 months from the closing date of the DLP Financing at a price of $0.13 per share. Each Unit Finder Warrant will entitle the holder thereof to acquire one DLP Share for a period of 24 months from the closing date of the DLP Financing at a price of $0.10 per share.

DLP intends to use the proceeds of the DLP Financing for the Transaction, general and administrative expenses for the next twelve months, exploration activities on the Aldridge Properties (as defined below), property maintenance costs and general working capital.

There is no assurance that the DLP Financing will be completed. All sales, exchanges, and issuances of any units, shares, warrants, and securities in connection to the DLP Financing and the Transaction will be subject to regulatory approval including, but not limited to, the approval of the TSXV and, as applicable, may be subject to the prior approval of the shareholders of either or both of MG and/or DLP.

Bridge Loan

MG will provide a bridge loan (the “Bridge Loan”) of $25,000 to DLP at an interest rate of 10% per annum in accordance with Section 8.5 of TSXV Policy 2.4 – Capital Pool Companies. The Bridge Loan will be used by DLP to preserve its assets, pay outstanding invoices related to the preparation of the technical report (described below) and other expenditures incurred while working towards completing the Transaction. The Bridge Loan and interest accrued thereon will be payable on the closing date of the Transaction and if the Transaction is not completed, 90 days from the date of the Amalgamation Agreement.

Resulting Issuer

After completion of the Transaction, and subject to approval by the shareholders of the Resulting Issuer, it is anticipated that the Resulting Issuer will change its name to “DLP Resources Inc.”, or such other name as may be acceptable to the Resulting Issuer.

Upon completion of the Transaction and assuming that (i) the minimum amount is raised under the DLP Financing and (ii) the Finder’s Fee is satisfied entirely through the issuance of 1,925,000 DLP Shares to Haywood, former shareholders of DLP will hold approximately 88.8% of the Resulting Issuer common shares (“Resulting Issuer Shares”) and MG shareholders will hold 11.2% of the Resulting Issuer Shares. It is anticipated that there will be an aggregate of approximately 49,223,461 Resulting Issuer Shares issued and outstanding and an additional 3,859,135 convertible securities of the Resulting Issuer exercisable into Resulting Issuer Shares assuming $525,000 is raised through the issuance of DLP FT Shares and $575,000 is raised through the issuance of DLP Units pursuant to the DLP Financing.

The Resulting Issuer will carry on the mineral exploration business conducted by DLP, and the Resulting Issuer Shares will be listed under a new trading symbol. On closing of the Transaction, the Resulting Issuer anticipates meeting the TSXV’s initial listing requirements for a mining issuer.

MG’s current directors are Peter McKeown, Jamie McVicar and Glenn Jamieson. Concurrent with the completion of the Transaction, Peter McKeown, Jamie McVicar and Glenn Jamieson, being all of the current directors of MG, will resign in favour of nominees of DLP, being James Stypula, who will also be appointed Chief Executive Officer, Richard Zimmer and William Bennett. Leslie Anne “Robin” Sudo will be appointed Chief Financial Officer and Corporate Secretary of the Resulting Issuer.

The directors and officers and or companies controlled by them collectively will own a total of 14,222,222 Resulting Issuer Shares of the Resulting Issuer or 28.9% of the total number of Resulting Issuer Shares.

Information as to the individual shareholdings of each of the current officers and directors of MG is available on SEDAR.

The following is a short background of each person who will be a director or officer of the Resulting Issuer on completion of the Transaction:

James Stypula, age 70, Chief Executive Officer and Director

Mr. James (Jim) Stypula is a businessman with over 30 years of experience and a former investment advisor and financier of mineral exploration and development companies in North and South America. Mr. Stypula is currently a director of Ascot Resources Ltd. Mr. Stypula was the former Chairman of the board of directors of Magellan Minerals Ltd. after its merger with Chapleau Resources Ltd. where he served as CEO and director.

Mr. Stypula was also one of the founding directors of Far West Mining Ltd. Mr. Stypula has acted on numerous board committees and has a wealth of business experience related to the mining industry, especially with respect to the small cap gold sector.

Mr. Stypula will be appointed as Chief Executive Officer and a Director of the Resulting Issuer and will also fill the role as head of Investors Relations. Mr. Stypula intends to devote 80% of his working time to the affairs of the Resulting Issuer. Mr. Stypula will be an employee of the Resulting Issuer. Mr. Stypula has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Leslie Anne “Robin” Sudo, age 60, Chief Financial Officer and Corporate Secretary. Ms. Leslie (Robin) Sudo has been actively involved in the mining exploration industry for 35 years, working with major and junior companies. During this time Ms. Sudo has accumulated a vast knowledge of the industry as she has served in a wide variety of roles including Chief Financial Officer, Accounting, Corporate Secretary, Corporate Governance and Internal Controls developer, Land Manager including mineral claim management, staking and permitting in numerous provinces and 2 territories. Ms. Sudo’s knowledge includes all aspects of Administration regarding an exploration office, managing property agreements, electronic filing of public documents (SEDAR) and has performed human resources work. Some of the companies Ms. Sudo has worked with are Cominco Ltd. (now Teck Resources Limited), Chapleau Resources Ltd., Consolidated Ramrod Gold Corp., Ryan Gold Corp., StrikePoint Gold Inc. and Ascot Resources Ltd.

Ms. Sudo will be appointed as Chief Financial Officer and Corporate Secretary of the Resulting Issuer. Ms. Sudo intends to devote 80% of her working time to the affairs of the Resulting Issuer. Ms. Sudo will be an employee of the Resulting Issuer. Ms. Sudo has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Richard Zimmer, age 70, Director

Mr. Zimmer has a degree in mining engineering and an MBA and has over 40 years of Canadian and international mining experience including exploration, development and mine operations (both underground and open pit). In the past, Mr. Zimmer served as: President and CEO of Far West Mining Ltd.; VP and Project Manager for Teck’s Pogo project in Alaska and General Manager of Teck’s Tarmoola gold mine in Australia; Mine Manager of Teck’s Afton copper-gold mine in British Columbia as well as acting in several senior mining roles throughout his career. Mr. Zimmer currently serves as a director of Ascot Resources Ltd., Capstone Mining Corp., and Alexco Resource Corp.

Mr. Zimmer will be appointed as Director of the Resulting Issuer. Mr. Zimmer intends to be available as required to attend to the affairs of the Resulting Issuer. Mr. Zimmer will not be an employee of the Resulting Issuer. Mr. Zimmer has not entered into any non-competition agreement with DLP or the Resulting Issuer.

William Bennett, age 69, Director

Mr. William (Bill) Bennett was formerly a government MLA in British Columbia (“BC”) for 16 years in the riding of Kootenay East. In addition to holding portfolios for Local Government and Tourism, Mr. Bennett was named BC Mines Minister three separate times over his 16 years. Mr. Bennett has a BA from the University of Guelph and a law degree from Queen’s University. Mr. Bennett is known across Canada for his knowledge of the mining industry in BC. He led the BC government’s efforts over many years to restore BC’s competitiveness for exploration investment, including having improved the BC Ministry of Energy & Mines permitting process and helping to launch BC’s First Nations mine revenue sharing program. There are few people in Canada who have such a strong combined knowledge of government processes, of the mining industry and of First Nations.

Mr. Bennett also sits on the board of directors of Ascot Resources Ltd., Kutcho Copper Corp., Eagle Plains Resources Ltd., Surge Exploration Inc. and Libero Copper Corporation. Mr. Bennett will be appointed as Director of the Resulting Issuer. Mr Bennett intends to be available as required to attend to the affairs of the Resulting Issuer. Mr. Bennett will not be an employee of the Resulting Issuer. Mr. Bennett has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Advisory Board of Resulting Issuer

In addition to the directors and executive officers of the Resulting Issuer, the Resulting Issuer intends to implement an advisory board (the “Advisory Board”). The following is a brief description of the members of the Advisory Board of the Resulting Issuer.

Derek White, Advisory Board Member

Mr. Derek White has over 30 years of international experience in the mining industry. Mr. White is currently President and CEO of Ascot Resources Ltd. Before joining Ascot, Mr. White acted as a Principal of Traxys Capital Partners LLP, a private firm specializing in the mining and materials sectors. Prior to joining Traxys, Mr. White was the President and CEO of KGHM International Ltd. from 2012 to 2015, overseeing six mining operations and four large development projects in Canada, the United States and Chile. He also held the positions of Executive Vice President, Business Development/Chief Financial Officer from 2004 to 2012 of Quadra FNX Mining Ltd. Mr. White has held executive positions in business development, operations and finance with BHP Billiton Plc, Billiton International Metals BV and Impala Platinum Holdings Ltd., in Vancouver, Toronto, London, the Hague, and Johannesburg. He is an ICSA Accredited Director and has served on a number of precious metal boards throughout his career. Mr. White holds an undergraduate degree in Geological Engineering from the University of British Columbia and is also a Chartered Accountant. Mr. White also currently serves as a director of MAG Silver Corp. and Orca Gold Inc. Mr. White will serve the Resulting Issuer as an advisor on an as-needed basis. Mr. White will not be an employee of the Resulting Issuer. Mr. White has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Mark D. Kucher, Advisory Board Member

Mr. Mark D. Kucher is the Founder and Managing Director of British Swiss Investment Corp. He founded British Swiss Investment Corp., in 1990. Mr. Kucher has also held the following positions: the Chief Executive Officer, President, and Director at Global Royalty Corp; the Executive Chairman, Chief Executive Officer, President and Secretary of Battle Mountain Gold Exploration Corp.; founded Battle Mountain Gold Exploration in 2005; served as Treasurer of Battle Mountain Gold Exploration Corp. since March 2006 and as its Chief Financial Officer since April 2004 to May 2006; Managing Director of Sovereign Trust company since March 1998.

Mr. Kucher has had various positions with investment banks and brokerage firms. He worked in investment banking with CIBC World Markets, BMO Harris Capital Markets, UBS Canada and Sprott Securities. From February 1995 to September 1997, Mr. Kucher served as the Chairman and Chief Executive Officer of Phelps Dodge Corporation. Among his credits, Mr. Kucher was directly involved as the Corporate Financier at Sprott Securities in the initial $45 million financing of Miramar Mining Corporation’s purchase of the Con Mine in 1993, the restructuring as Chief Financial Officer of Princeton Mining Corporation during their restart of the Similco Mine and the subsequent acquisition and build out of the $100 million Huckleberry Mine and as Chairman in the $110 million amalgamation of Aurex Resources Inc. with Cobre Mining Company and its ultimate acquisition in 1998 by Phelps Dodge Mining Company. Mr. Kucher has served as Chairman of Hudson Ventures, Inc., Quepasa.com, Inc. and Cobre Mining Company. Mr. Kucher has 25 years of experience in Resource Finance in Investment Banking, Mergers and Acquisitions, Merchant Banking and Institutional Coverage. During his career, Mr. Kucher has founded and sold 3 gold royalty companies to Royal Gold, AngloGold Ashanti and Coeur Mining. Mr. Kucher earned an M.B.A. from the University of Western Ontario in 1984 and a Bachelor of Commerce in Honors from the University of Manitoba.

Mr. Kucher will serve the Resulting Issuer as an advisor on an as-needed basis. Mr. Kucher will not be an employee of the Resulting Issuer. Mr. Kucher has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Luke Alexander, Advisory Board Member

In 2018, Mr. Alexander founded Park Road Capital, a capital markets advisory group focused on the global Natural Resource sector. Prior to Park Road Capital, Mr. Alexander was a managing director at GMP Securities based in Vancouver. Before relocating to Vancouver, Mr. Alexander spent 12 years in London, UK, covering the Natural Resource sector. During his time in London he was a senior partner at GMP Securities Europe, Vice President at National Bank Financial where he helped establish their first equity trading desk in London, and an equity sales trader at TD Securities. Mr. Alexander began his career working in the private client group at BMO Nesbitt Burns.

Mr. Alexander will serve the Resulting Issuer as an advisor on an as-needed basis. Mr. Alexander will not be an employee of the Resulting Issuer. Mr. Alexander has not entered into any non-competition agreement with DLP or the Resulting Issuer.

David L. Pighin, Consulting Geologist of Advisory Board

Mr. David Pighin has dedicated his working life to mining and exploration geology and has been actively involved in the industry for 53 years. He started his career with Cominco Ltd. (now Teck) as a professional Prospector and was promoted to Geologist in 1977. In 1989, after 24 years, Mr. Pighin left Cominco. Since 1989, Mr. Pighin became a consulting geologist and has worked for numerous junior exploration companies. He has worked in BC, the Yukon, the Northwest Territories, New Brunswick as well as most of the western United States and Mexico. Mr. Pighin has planned and managed numerous exploration programs designed to find deposits of base metals, tungsten, moly, gold, diamonds and rare earth metals. During 1993, Mr. Pighin ascertained the designation of P.Geo.

Mr. Pighin has discovered the following significant exploration properties:

the Fors Property (PB, Zn, Ag); the Cedar Property (Tungsten); the Vine Property (Pb, Zn, Ag, Au); the Streamboat Property (Pb, Zn, Ba); the Cross Property (discovered and recognized 4 Kimberlite pipes); the Fen Property (rare earth metals); the Boulder Gold Property (Au) Mr. Pighin is a “qualified person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Mr. Pighin will serve the Resulting Issuer as an advisor on an as-needed basis. Mr. Pighin will not be an employee of the Resulting Issuer. Mr. Pighin has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Carol Li, Financial Advisor of Advisory Board

Ms. Carol Li is a Canadian Chartered Professional Accountant with over 20 years of financial and executive management experience, of which 14 years in mining. Ms. Li was appointed as Chief Financial Officer of Ascot Resources Ltd. on November 2, 2017. Ms. Li was formerly Vice President, Finance for KGHM International Ltd. from 2012 to 2017 and Corporate Controller for Quadra/QuadraFNX Mining Ltd. from 2004 to 2012. Ms.Li became a director of Strikepoint Gold Inc. on June 3, 2019 as a representative for Ascot Resources as one of Strikepoint’s largest shareholders.

Ms. Li will serve the Resulting Issuer as an advisor on an as-needed basis. Ms. Li will not be an employee of the Resulting Issuer. Ms. Li has not entered into any non-competition agreement with DLP or the Resulting Issuer.

Non-Arm’s Length Relationships

The Transaction will not constitute a Non-Arm’s Length Qualifying Transaction (as such term is defined in the policies of the TSXV). No Insider, Promoter or Control Person as such terms are defined in the policies of the TSXV) of MG has any material interest in DLP prior to giving effect to the Transaction and no such persons are also insiders of DLP.

Sponsorship

Sponsorship of a qualifying transaction is required by the TSXV unless exempt in accordance with TSXV policies. The parties intend to apply for an exemption from the sponsorship requirements of the TSXV.

Filing Statement

In connection with the Transaction and pursuant to the requirements of the TSXV, MG will file a filing statement (the “Filing Statement”) on its issuer profile on SEDAR (www.sedar.com), which will contain details regarding the Transaction, MG, DLP and the Resulting Issuer.

About MG Capital Corporation

MG Capital Corporation is a capital pool company. The Corporation’s principal business activity is to identify and evaluate opportunities for acquisition of assets or business. The Corporation is headquartered in Banff,Alberta.

About DLP Resources Inc.

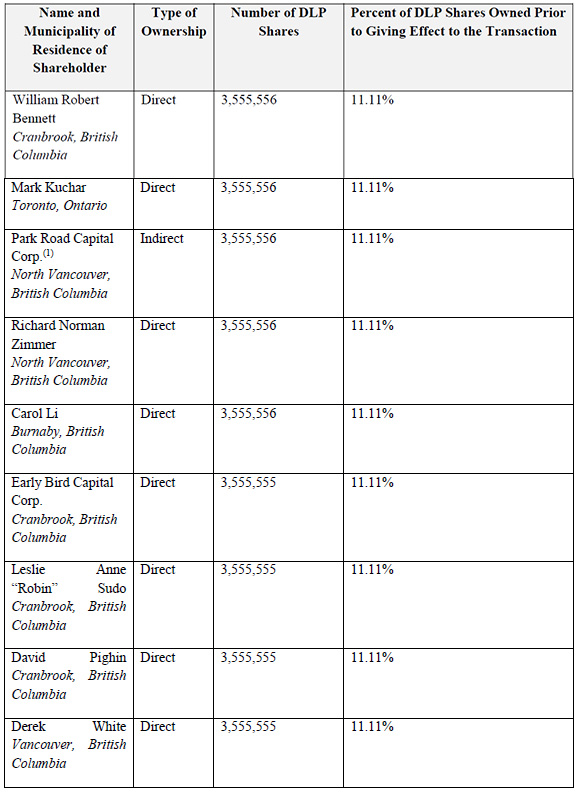

DLP Resources Inc. is a natural resource company which was formed under the laws of the Province of British Columbia on June 7, 2019. As of the date hereof, there are 32,000,000 DLP Shares outstanding. The following persons own, control or direct 10% of more of the outstanding DLP Shares:

- Luke Alexander owns 100% of the voting securities of Park Road Capital Corp. and is the beneficial holder of the DLP Shares held by Park Road Capital Corp.

- John James Stypula owns 100% of the voting securities Early Bird Capital Corp. and is the beneficial holder of the DLP Shares held by Early Bird Capital Corp.

DLP’s principal business activity is in the ownership and management of mining assets in British Columbia, Canada. It owns 100% of an exploration-stage property located northeast of Golden B.C. which is prospective for copper and cobalt. This property was originally explored in the early 1970’s and has seen little field activity since that time. DLP also owns a 100% interest in other exploration-stage properties of merit located in the Cranbrook-Creston corridor which are of interest due to their lead, zinc and silver potential (the “Aldridge Property”). DLP is headquartered in Cranbrook, British Columbia.

DLP’s principal property is the Aldridge Property which covers approximately 4,650 hectares. The claims which comprise the Aldridge Property are currently owned 100% by DLP, and are not subject to any royalties, back-in rights, option payments, encumbrances or other agreements except for a 1% net smelter royalty on certain mineral claims in favour of Robin Sudo and James Stypula. Exploration work conducted on behalf of DLP in 2019 has been limited to geological mapping on the Aldridge Property.

A technical report that complies with NI 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the policies of the TSXV has been prepared for the Aldridge Property and has been filed with the TSXV for its review and acceptance. It is anticipated that the technical report will be filed on SEDAR under the Company’s profile in conjunction with the filing of its Filing Statement.

The technical information in this news release was reviewed and approved by Douglas Anderson, P.Eng, a “qualified person” for the purposes of NI 43-101.

Based on the unaudited financial statements of DLP for the period from its incorporation on June 7, 2019 to July 31, 2019, DLP had no revenue, comprehensive loss of $42,257, total assets of $86,789, total liabilities of $39,046, and shareholders’ equity of $47,743 as at July 31, 2019.

Contact Information

MG Capital Corporation

Peter McKeown

President, Chief Executive Officer, Chief Financial Officer, and Corporate Secretary 1-403-689-4052

Additional Information

In accordance with Exchange policy, the Corporation’s shares are currently halted from trading and will remain so until such time as the Exchange determines, which, depending on the policies of the Exchange, may not occur until the completion of the Transaction.

Completion of the Transaction is subject to a number of conditions including but not limited to, the closing of DLP Financing, TSXV acceptance and if applicable pursuant to TSXV requirements, majority of the minority shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSXV has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this press release.

Cautionary Statements

Although the Corporation believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Corporation can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “will”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the business plans of MG, DLP and the Resulting Issuer, the Transaction (including TSXV approval, potential shareholder approval, and the closing of the Transaction), the timing of the Transaction, the board of directors and management of the Resulting Issuer upon completion of the Transaction, the name change of the Resulting Issuer, the DLP Financing, the Bridge Loan, the payment of the Finder’s Fee and the filing of a technical report. Such statements and information reflect the current views of MG and/or DLP, respectively. Risks and uncertainties may cause actual results to differ materially from those contemplated in those forward-looking statements and information.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: (i) there is no assurance that MG and DLP will obtain all requisite approvals for the Transaction, including the approval of the shareholders of DLP, or the approval of the Exchange for the Transaction (which may be conditional upon amendments to the terms of the Transaction); (ii) there is no assurance the DLP Financing will be completed as contemplated or at all; (iii) following completion of the Transaction, the Resulting Issuer may require additional financing from time to time in order to continue its operations and financing may not be available when needed or on terms and conditions acceptable to the Resulting Issuer; (iv) new laws or regulations could adversely affect the Resulting Issuer’s business and results of operations; and (v) the stock markets have experienced volatility that often has been unrelated to the performance of companies. These fluctuations may adversely affect the price of the Resulting Issuer’s securities, regardless of its operating performance. There are a number of important factors that could cause MG’s and DLP’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: currency fluctuations; limited business history of MG and/or DLP; disruptions or changes in the credit or security markets; results of operation activities and development of projects; project cost overruns or unanticipated costs and expenses, and general market and industry conditions. The definitive terms and conditions of the Transaction may be based on the Corporation’s due diligence and the receipt of tax, corporate and securities law advice for both the Corporation and DLP. The Corporation undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of the Corporation, DLP, their securities, or their respective financial or operating results (as applicable).

MG cautions that the foregoing list of material factors is not exhaustive. When relying on MG’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. MG has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forwardlooking information contained in this press release represents the expectations of MG as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. MG does not undertake to update this information at any particular time except as required in accordance with applicable laws.

This press release is not an offer of the securities for sale in the United States. The securities have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an exemption from registration. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.